MTN CEO Warns U.S. Tariffs Could Hurt Telecom Spending

Ralph Mupita, Chief Executive Officer of MTN Group, has issued a stark warning about the potential damage that former U.S. President Donald Trump’s aggressive tariff policies could inflict on telecommunications infrastructure development worldwide. Speaking at a press briefing held at the company’s Fairland headquarters in Johannesburg, Mupita explained how these protectionist trade measures may trigger a chain reaction of rising costs that would particularly impact emerging markets.

The MTN leader’s comments come during a period of heightened economic uncertainty as Trump’s trade policies regain prominence. Mupita suggested the global economy stands just weeks away from experiencing the full brunt of these measures. “Our projections indicate slowing global economic growth,” he stated. “The sustained imposition of these tariffs will likely maintain inflationary pressures at higher levels than we would normally anticipate.”

This economic environment presents specific challenges for telecommunications providers. The anticipated cost increases for essential network components, particularly radio access equipment, may compel operators to fundamentally rethink their pricing structures to maintain financial viability.

MTN’s Strategic Financial Planning

As Africa’s largest mobile network operator by revenue, MTN has committed substantial resources to infrastructure development. The company has earmarked approximately $2 billion for capital expenditures during its 2025 fiscal year. This investment will support network expansion and modernization across its 17 African markets, addressing the continent’s rapidly growing demand for digital connectivity.

Mupita emphasized the complex, long-term nature of infrastructure planning in the telecom sector. “Our capital expenditure programs require multi-year planning horizons,” he noted. “Equipment procurement contracts are typically finalized well in advance of deployment.” This forward-looking approach currently provides MTN with some insulation from immediate supply chain disruptions. “For 2025, our supply agreements are largely finalized, which should protect us from near-term volatility,” Mupita explained.

The Chinese Supply Chain Advantage

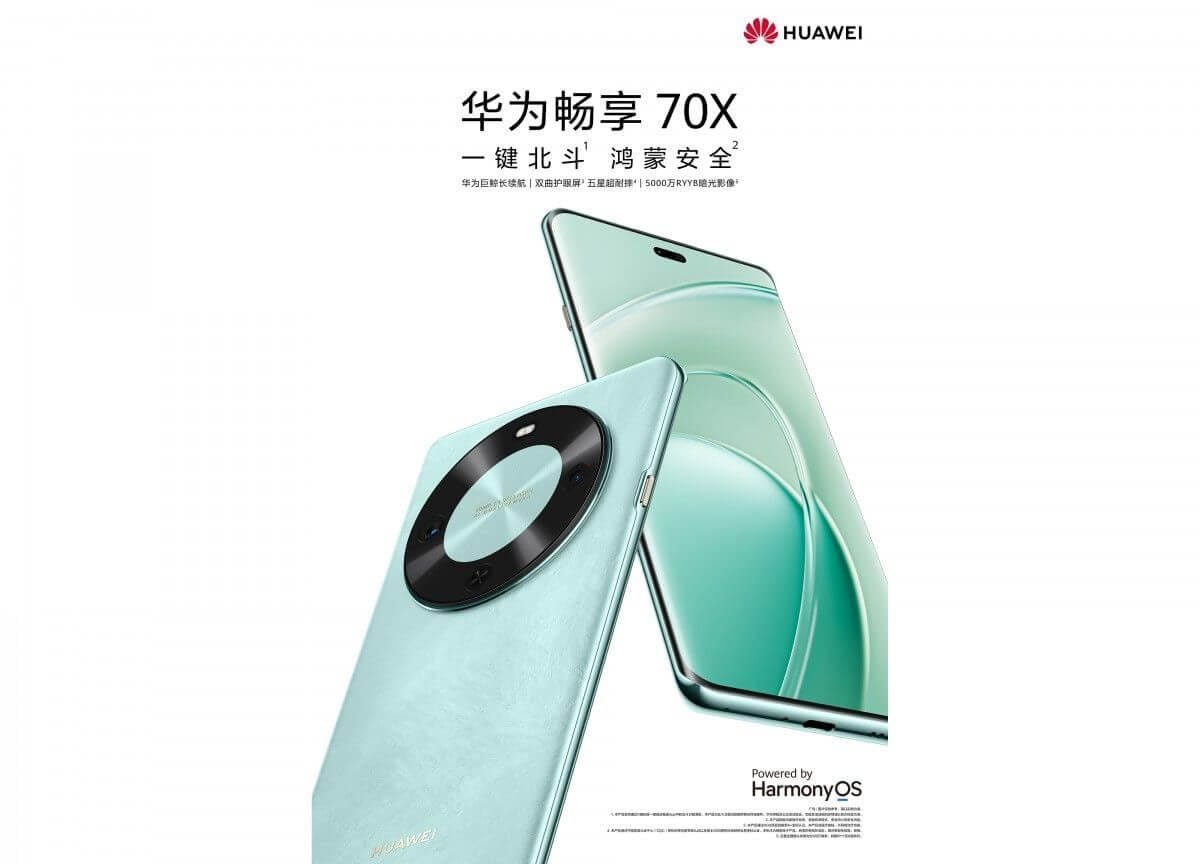

A critical element of MTN’s operational strategy involves its reliance on Chinese manufacturers, primarily Huawei Technologies, for radio access network equipment. This procurement approach reflects the economic realities of operating in African markets.

“We prioritize cost-effective solutions from Chinese vendors rather than more expensive alternatives like Sweden’s Ericsson,” Mupita stated, highlighting the company’s pragmatic approach to infrastructure development. Huawei’s dominant position in the global radio equipment market, where it supplies an estimated 85% of total demand, further reinforces this strategic choice.

Navigating Geopolitical Tensions

The escalating trade conflict between the United States and China has raised concerns about potential fragmentation in global technology markets. Industry analysts have begun discussing the possibility of a “splinternet” scenario, where differing technical standards and supply chains could emerge between Western and Eastern technology ecosystems.

For MTN, which operates hybrid network infrastructure incorporating both European core systems and Chinese radio components, maintaining operational flexibility remains paramount. “We don’t align with any particular geopolitical bloc,” Mupita clarified. “Our equipment selection process focuses solely on identifying the optimal technical solutions for our network requirements.”

Long-Term Industry Challenges

While MTN’s current procurement strategy provides short-term stability, persistent tariffs could eventually erode the cost advantages of Chinese equipment. This scenario would force African operators to choose between absorbing higher operational costs or passing these expenses on to consumers – neither option being particularly palatable in price-sensitive emerging markets.

The situation appears especially precarious in Africa, where economic volatility and limited consumer purchasing power already constrain pricing flexibility. “We must remain vigilant about our supply chain dynamics and the geographic origins of our critical network components,” Mupita cautioned, suggesting potential strategic adjustments may become necessary.

Broader Industry Implications

The telecommunications sector as a whole faces mounting challenges from these trade policies. Experts warn that sustained tariffs could amplify existing pressures in key MTN markets like Nigeria and South Africa, where currency fluctuations and political instability already complicate operations.

Recent research from GSMA Intelligence projects mobile internet adoption in Sub-Saharan Africa growing from 57% penetration in 2023 to 65% by 2030, driven by continued infrastructure investment. However, rising equipment costs threaten to slow this progress, potentially widening rather than narrowing the continent’s digital divide.

Strategic Vision for the Future

Mupita’s warnings align with MTN’s broader corporate strategy outlined in its “Ambition 2025” initiative. Launched in 2021, this transformation program aims to evolve MTN from a traditional mobile network operator into a comprehensive digital services platform. The strategy encompasses significant investments in financial technology, digital services, and next-generation infrastructure.

Regional Developments

In related news, MTN Nigeria has proposed combining its MoMo Payment Service Bank with Yello Digital Financial Services to create an enhanced financial services platform. Additionally, the company recently committed $1 billion to network expansion in Ghana following the resolution of a tax dispute with local authorities.

As MTN explores potential satellite internet partnerships ahead of Starlink’s South African market entry, the company continues to navigate complex economic headwinds while pursuing its ambitious digital transformation agenda across the African continent.