Top 5 Cryptocurrency Exchange Platforms with the Best Rates in 2025

As the use of cryptocurrencies grows around the world, traders and investors must choose a reliable and effective cryptocurrency exchange.

Platforms like Coinbase, Bybit, Kraken, Binance, and OKX (previously OKEx) are leading the way in what is expected to be another pivotal year for the cryptocurrency industry in 2025. These exchanges’ dependability, inventiveness, and adherence to legal requirements have all been repeatedly demonstrated.

The following section will examine the performance of these platforms throughout time, their adherence to governmental regulations, their distinctive qualities, and their prospects for this year.

Top 5 Cryptocurrency Exchange Platforms with the Best Rates

Here are best five cryptocurrency exchanges platform with very low rate in 2025.

1. Bybit

Bybit was established in 2018 and has rapidly gained traction among crypto traders, particularly in the derivatives trading space. It has earned a strong reputation for its innovative features, user-friendly interface, and high liquidity, which has made it a go-to platform for both novice and professional traders.

Growth and Popularity

By Q4 2023, Bybit had over 15 million registered users globally, positioning itself as one of the top players in the crypto trading market. It consistently ranks among the top 5 crypto derivatives exchanges by trading volume, with daily volumes regularly surpassing $10 billion. The platform’s rise can be attributed to its low fees, high leverage options, and a wide range of available trading pairs, making it especially appealing to active traders who engage in leveraged trading.

Regulatory Environment

Bybit, like many exchanges in the crypto industry, has had to navigate a complex regulatory landscape. While the platform has been working towards ensuring compliance with global regulations, it has faced challenges, particularly in the United States and other heavily regulated markets. Despite these hurdles, Bybit continues to grow and is making strides toward improving its compliance practices in multiple regions. The company has already secured licenses in some jurisdictions, such as Dubai, and has committed to strengthening its global compliance framework.

Security Measures

Bybit places a strong emphasis on security to protect its users’ assets and personal information:

Cold Storage: The majority of user funds are kept in cold storage, minimizing the risk of online attacks.

Two-Factor Authentication (2FA): All users are encouraged to enable 2FA to add an extra layer of security to their accounts.

Insurance Fund: Bybit’s insurance fund is designed to cover any potential losses due to a system malfunction or hack.

Regular Audits: The platform frequently conducts security audits to ensure its infrastructure is secure and resilient to potential vulnerabilities.

What Makes Bybit Stand Out

Bybit is best known for its focus on derivatives trading. It offers a range of products such as perpetual contracts, futures, and options for traders to leverage, allowing for greater flexibility and opportunities in volatile markets. Additionally, Bybit provides up to 100x leverage on selected contracts, allowing traders to maximize their potential profits (though, of course, this also increases risk).

Another standout feature of Bybit is its robust mobile app, which allows users to trade anytime, anywhere. The platform also offers advanced trading tools, including charting software and real-time market data, making it an ideal choice for more experienced traders looking to make technical, data-driven decisions.

Rates

Trading Fees: Bybit uses a maker-taker fee model. Makers (who add liquidity) are charged 0.02%, while takers (who take liquidity) are charged 0.06%. These fees are among the most competitive in the crypto derivatives space.

Withdrawal Fees: Bybit’s withdrawal fees depend on the cryptocurrency being withdrawn. For Bitcoin, the withdrawal fee is typically 0.0005 BTC.

Looking Ahead to 2025

Bybit’s trajectory toward 2025 seems to be heading in an exciting direction:

Institutional Adoption: Bybit is expected to continue targeting institutional investors, offering more tailored solutions like over-the-counter (OTC) trading and custody services for large-scale clients.

Global Expansion: The platform will likely continue to extend its reach, particularly in Asia and other emerging markets where demand for crypto derivatives is growing. Bybit has also expressed interest in expanding into more regulated markets, which could open new growth opportunities.

Innovative Product Launches: Bybit is expected to launch more innovative trading products, including new derivatives and DeFi offerings, to meet the evolving needs of traders.

Improved Compliance: As part of its commitment to regulatory alignment, Bybit is likely to implement more stringent compliance measures to align with global standards, particularly in Europe and North America.

2. Coinbase

Coinbase, founded in 2012 and headquartered in San Francisco, is one of the most widely recognized and trusted cryptocurrency exchanges in the world. With its user-friendly interface, robust security measures, and commitment to regulatory compliance, Coinbase has become a go-to platform for both beginner and experienced cryptocurrency traders globally.

Growth and Popularity

Since its inception, Coinbase has experienced tremendous growth. By the end of 2023, Coinbase had over 110 million verified users, making it one of the largest cryptocurrency exchanges globally. The platform has played a crucial role in making cryptocurrency more accessible to the mainstream, particularly in the United States. Coinbase’s IPO in 2021 on the NASDAQ further cemented its status as a legitimate player in the financial ecosystem, providing a level of transparency and trust that many other exchanges have yet to achieve.

Regulatory Standing

Coinbase is known for its commitment to adhering to regulatory standards. It has worked closely with regulators in key markets like the United States, the European Union, and Singapore. As a publicly traded company, it is subject to regular audits and must meet stringent reporting requirements, adding an extra layer of trust for users and investors.

Coinbase has become a pioneer in regulatory compliance, holding licenses in multiple jurisdictions, including the U.S. Financial Crimes Enforcement Network (FinCEN) and being registered as a Money Services Business (MSB). Its proactive approach to compliance has earned it a reputation as one of the most regulated and transparent exchanges in the industry. Coinbase has also collaborated with the U.S. Securities and Exchange Commission (SEC) and other regulatory bodies to advocate for clearer rules surrounding cryptocurrency trading.

Security Measures

Security is a top priority for Coinbase, and it employs a variety of advanced measures to protect user assets:

- Cold Storage: Coinbase stores about 98% of customer funds in offline, cold storage to prevent hacking and unauthorized access.

- Two-Factor Authentication (2FA): Coinbase offers 2FA to ensure an additional layer of protection on all user accounts.

- Insurance Coverage: Coinbase provides insurance coverage for digital assets held in its custodial wallets, giving users peace of mind.

- Advanced Encryption: Coinbase uses state-of-the-art encryption protocols to ensure that user data is safe and secure.

These security features make Coinbase a reliable choice for users concerned about the safety of their digital assets.

What Sets Coinbase Apart

Coinbase is particularly known for its easy-to-use interface and the educational resources it offers to users new to cryptocurrency. Its Coinbase Earn program allows users to earn small amounts of cryptocurrency by learning about different digital assets. This educational approach helps demystify the world of crypto and encourages newcomers to engage with the market.

Additionally, Coinbase’s focus on compliance and regulatory transparency makes it an ideal choice for institutional investors. Its Coinbase Pro platform offers advanced trading tools and lower fees, catering to experienced traders who need more sophisticated features and deeper liquidity.

Coinbase’s liquidity is another standout feature. As one of the largest exchanges by volume, it offers high liquidity, which reduces slippage for large trades. This is especially important for institutional traders and professional investors.

Rates

- Trading Fees: Coinbase’s fee structure is tiered based on the amount of the transaction and the payment method. Standard fees are 1.49% for buys and sells, but users who pay with bank transfers or use Coinbase Pro can enjoy reduced rates. Coinbase Pro offers fees as low as 0.04% for makers and 0.10% for takers depending on the trading volume.

- Withdrawal Fees: Coinbase charges withdrawal fees based on the cryptocurrency being withdrawn. For example, the withdrawal fee for Bitcoin is approximately 0.0005 BTC. Fees for other cryptocurrencies vary depending on the network’s congestion.

What’s in Store for Coinbase in 2025?

Looking ahead, Coinbase is poised for further growth, with several exciting developments expected in 2025:

- Crypto Integration into Traditional Finance: Coinbase is likely to expand its efforts in integrating cryptocurrencies into traditional financial systems. This includes offering tailored solutions for institutional clients, corporate treasuries, and brokers, thereby bridging the gap between traditional finance and digital assets.

- New Products and Features: Coinbase is expected to launch new assets and trading features, including expanded support for crypto futures, options, and other advanced trading products. The launch of the Coinbase 50 (COIN 50) index will provide a comprehensive benchmark for top-performing digital assets, making it easier for investors to track crypto market performance.

- International Expansion: As part of its 2025 strategy, Coinbase will likely focus more on international markets, particularly in Asia. It plans to expand its derivatives offerings and introduce new crypto products tailored to the needs of different regions.

- Continued Regulatory Efforts: Coinbase will continue to work closely with regulators worldwide to ensure it remains compliant with evolving rules. This includes enhancing its compliance with upcoming regulations in Europe, North America, and Asia.

Coinbase’s Future for Institutional Investors

Institutional investors are becoming an increasingly important part of the crypto ecosystem, and Coinbase has been positioning itself to meet their needs. The platform’s services, such as Coinbase Prime, provide institutional clients with tailored tools for trading and asset management. This includes features such as cross-margining, advanced trading APIs, and high-level reporting.

As the regulatory landscape becomes clearer, more institutional investors will likely enter the market, and Coinbase is expected to be a leading exchange catering to this demographic. Coinbase’s strong compliance and regulatory framework give it a competitive advantage when it comes to attracting institutional clients who require a secure and regulated environment for trading.

3. Binance

Founded in 2017 by Changpeng Zhao (commonly known as CZ), Binance has become one of the largest and most influential cryptocurrency exchanges in the world. Known for its comprehensive platform that supports a wide range of services, from spot trading to futures, staking, and decentralized finance (DeFi)—Binance has grown exponentially to become a dominant player in the crypto space.

Growth and Popularity

In just a few years since its inception, Binance quickly gained global traction. By Q4 2023, Binance had over 100 million users across more than 180 countries. It has consistently ranked as the largest cryptocurrency exchange by daily trading volume, often surpassing $20 billion in daily trades. Binance’s ability to offer low fees, high liquidity, and a broad selection of cryptocurrencies has made it the go-to exchange for traders of all experience levels.

Binance’s growth has been powered by its continuous innovation, offering a range of products and services to cater to every type of investor. The platform supports trading in hundreds of cryptocurrencies, and with its robust mobile and web applications, Binance remains one of the most accessible platforms for crypto enthusiasts around the world.

Regulatory Standing

Binance has faced some regulatory challenges, particularly in key markets like the United States, the U.K., Japan, and Canada. In 2021 and 2022, Binance came under scrutiny from several regulatory bodies due to concerns over its compliance with local laws regarding anti-money laundering (AML) and know-your-customer (KYC) practices. However, Binance has made significant efforts to improve its regulatory compliance, hiring former regulatory officials and working to meet the legal standards of various regions.

The company has also been taking steps toward securing more licenses globally, including acquiring regulatory approval in jurisdictions such as the Cayman Islands, Dubai, and Malta. Binance continues to push for regulatory clarity in order to expand its services in key markets while ensuring it complies with local laws.

Security Measures

Security is a top priority for Binance, and the platform employs a comprehensive set of measures to ensure the safety of its users’ funds and personal information:

- Cold Storage: Binance stores the majority of its customers’ funds in offline cold storage, reducing the risk of hacking or cyberattacks.

- Two-Factor Authentication (2FA): All accounts on Binance must have 2FA enabled, adding an additional layer of security to user accounts.

- Security Token Insurance Fund (SAFU): Binance has a Secure Asset Fund for Users (SAFU) that ensures protection for users in the event of a security breach. This fund helps cover potential losses resulting from attacks on the platform.

- Regular Security Audits: Binance regularly performs security audits and works with cybersecurity experts to ensure its platform remains secure from potential vulnerabilities.

- Advanced Encryption: The platform uses cutting-edge encryption to protect users’ personal and financial data.

These security measures, coupled with Binance’s proactive approach to addressing vulnerabilities, make it one of the most secure exchanges in the crypto space.

What Makes Binance Stand Out

Binance’s broad range of offerings is what sets it apart from many other exchanges. It is not just a cryptocurrency exchange; it’s an entire ecosystem for trading and investing in digital assets. Some of its key features include:

- Low Trading Fees: Binance is known for its highly competitive fee structure. The platform charges a flat 0.10% fee for both makers and takers, which is significantly lower than many of its competitors. Additionally, users can reduce their fees by holding Binance’s native token, BNB (Binance Coin).

- Wide Selection of Cryptocurrencies: Binance supports a vast number of cryptocurrencies—over 350 different digital assets—making it an ideal platform for traders looking for variety and exposure to a wide range of altcoins.

- Binance Coin (BNB): Binance’s native token, BNB, offers several use cases on the platform, including fee discounts, trading, staking, and participation in token sales on Binance Launchpad.

- Derivatives Trading: Binance also supports futures and options trading, with leverage as high as 125x on certain contracts, providing advanced traders with more ways to gain exposure to the crypto market.

- Staking and DeFi Products: Binance offers staking services, allowing users to earn rewards by participating in the proof-of-stake (PoS) networks. Additionally, Binance’s involvement in decentralized finance (DeFi) has grown, offering users the ability to trade and invest in DeFi protocols directly from the platform.

The sheer variety of services and low fees make Binance a platform that attracts both individual retail traders and large institutional investors.

Rates

- Trading Fees: Binance’s standard trading fee is 0.10% for both makers and takers. However, users can enjoy discounts by holding BNB tokens, and the fee is reduced further if the trader’s 30-day volume exceeds certain thresholds. For example, users can pay as little as 0.02% as a maker and 0.04% as a taker with a high enough trading volume or when using BNB for fees.

- Withdrawal Fees: Binance’s withdrawal fees vary by cryptocurrency. For example, the Bitcoin withdrawal fee is 0.0005 BTC, while the Ethereum withdrawal fee is around 0.005 ETH. These fees depend on the network’s congestion and can fluctuate accordingly.

What to Expect from Binance in 2025

Binance’s roadmap for 2025 is filled with plans for expansion and innovation. As the leading cryptocurrency exchange, Binance is focused on maintaining its competitive edge and continuing to offer groundbreaking features:

- Global Expansion: Binance will likely continue its expansion efforts, particularly focusing on emerging markets like Southeast Asia, Africa, and Latin America. The platform is expected to further solidify its presence in regions that are seeing growing interest in cryptocurrency.

- DeFi Integration: With the continued rise of decentralized finance, Binance is likely to deepen its involvement in DeFi and launch new DeFi products. This may include more partnerships with decentralized protocols, additional yield farming opportunities, and further integration with decentralized exchanges (DEXs).

- Regulatory Alignment: Binance will likely continue to prioritize regulatory compliance as it works to secure licenses in more jurisdictions. As the regulatory environment around crypto evolves, Binance will strive to ensure that it adheres to the rules of every market it operates in, especially in the United States, Europe, and Asia.

- Institutional Growth: Binance is expected to expand its institutional services with more offerings designed for large-scale investors, including more advanced trading products, OTC services, and prime brokerage solutions.

- New Products and Features: Binance is continuously evolving and may introduce new products and features, such as enhanced leverage options, more advanced derivatives, NFTs, and even more ways for users to stake their crypto assets for rewards.

- Blockchain and Infrastructure Development: Binance may continue to invest in blockchain technology and build its ecosystem around Binance Smart Chain (BSC), a fast-growing smart contract platform designed to offer lower transaction fees and faster speeds than Ethereum. BSC’s growing adoption will likely be a key driver for Binance’s future.

4.OKX

OKX was founded in 2017 and is headquartered in Hong Kong. It has quickly become one of the top cryptocurrency exchanges in the world. The platform offers a variety of services, including spot trading, futures, margin trading, and even decentralized finance (DeFi) options. OKX is known for providing tools that cater to both beginner and experienced traders, making it a popular choice for crypto enthusiasts globally.

Growth and Popularity

OKX has grown rapidly and, by late 2023, had over 20 million registered users. It regularly ranks among the top exchanges in terms of trading volume, handling over $5 billion in daily trades. This growth has come from offering a wide range of cryptocurrencies and trading options, making it a favorite for traders around the world, particularly in Asia, Europe, and emerging markets.

Regulatory Compliance

OKX has worked hard to meet the regulations in various countries. While it faced some challenges, especially in major markets, it has been taking steps to improve its compliance with local laws. This includes adopting strong KYC (Know Your Customer) and AML (Anti-Money Laundering) practices to ensure transparency and security.

The platform has obtained licenses in places like the Cayman Islands and Malta, allowing it to operate more clearly and openly in those regions.

Security Features

OKX prioritizes security with several measures to protect user funds:

- Cold Storage: Most of users’ funds are kept offline in cold storage to protect them from hacks.

- Two-Factor Authentication (2FA): Users must enable 2FA, adding an extra layer of security when logging into their accounts.

- Insurance Fund: OKX has an insurance fund to cover potential losses in case of system failures or attacks.

- Regular Audits: The platform regularly reviews its security to make sure it’s up to date and safe for users.

- Cold Wallets: Only a small percentage of funds are kept in hot wallets, which are protected by strong security measures.

These features help make OKX a secure platform for trading and storing cryptocurrencies.

What Makes OKX Special

OKX stands out with its wide range of trading options and features:

- Advanced Trading Options: Whether you’re into spot trading, futures, or margin trading, OKX offers various ways to trade cryptocurrencies. This makes it suitable for both beginners and professional traders.

- Staking & Yield Farming: Users can earn rewards by staking their coins or participating in yield farming. This gives traders another way to earn passive income.

- Wide Selection of Cryptos: OKX supports hundreds of cryptocurrencies, including major ones like Bitcoin and Ethereum, as well as smaller altcoins. This gives traders a lot of options.

- DeFi Access: OKX offers access to decentralized finance (DeFi) products, allowing users to interact with decentralized exchanges and earn returns from DeFi protocols.

- OKB Token: OKX has its own token, OKB, which gives holders benefits like discounted trading fees and access to exclusive products.

Fees

- Trading Fees: OKX’s fees are competitive. The basic trading fee is 0.10% for both makers and takers. If you hold OKB, the platform’s native token, you can reduce the fee even further. For users with high trading volume, fees can be as low as 0.08%.

- Withdrawal Fees: Withdrawal fees depend on the cryptocurrency being withdrawn. For example, withdrawing Bitcoin costs around 0.0005 BTC, while withdrawing Ethereum costs about 0.01 ETH. These fees may change depending on network conditions.

What’s Next for OKX in 2025

OKX is focused on growth and improving its services in 2025:

- Global Expansion: OKX is likely to continue expanding into new markets, particularly in Southeast Asia, Africa, and South America, where crypto adoption is rising.

- Institutional Clients: OKX is also focusing on attracting large institutional traders. The platform will likely add more tools designed for big investors, like OTC trading and advanced analytics.

- New Products: OKX plans to keep improving its product offerings, including more ways to trade, stake, and earn on the platform. It may also continue adding new features like more DeFi integrations.

- Regulatory Efforts: OKX will likely continue its efforts to comply with regulations in different countries to expand its reach while keeping users safe and secure.

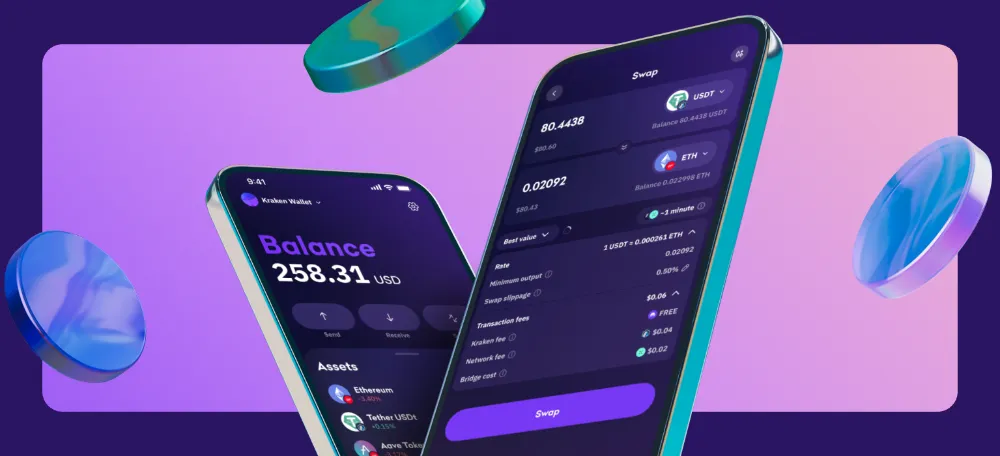

5. Kraken Wallet

Founded in 2011, Kraken wallet is one of the oldest and most trusted cryptocurrency exchanges in the world. Based in the United States, Kraken has earned a strong reputation for security, transparency, and reliability. It offers a wide range of services for both beginners and advanced traders, including spot trading, futures, staking, and margin trading.

Growth and Popularity

Kraken has grown steadily over the years and now serves millions of customers worldwide. It is consistently ranked among the top exchanges by trading volume, with over $1 billion in daily trading volume in 2023. Kraken’s commitment to security, regulation, and customer support has helped it remain a popular choice for crypto enthusiasts.

The platform has built a solid customer base in North America, Europe, and Asia, and is known for its easy-to-use interface and customer service.

Regulatory Compliance

Kraken is known for its commitment to regulatory compliance. It operates in several countries and is licensed in places like the United States and Europe. Kraken is registered with the U.S. Financial Crimes Enforcement Network (FinCEN) and complies with anti-money laundering (AML) and know-your-customer (KYC) regulations.

Kraken has worked closely with regulators to ensure that it meets all legal requirements, making it a reliable and trustworthy platform for users who want to stay within the rules.

Security Features

Kraken places a high priority on security and has a strong track record in this area. Some of the key security features include:

- Cold Storage: Kraken stores the majority of users’ funds in cold storage, ensuring they are offline and safe from hackers.

- Two-Factor Authentication (2FA): Kraken requires 2FA for account access, adding an extra layer of protection to user accounts.

- Insurance Fund: Kraken has an insurance fund to protect against potential losses in the event of a breach, adding peace of mind for users.

- Regular Security Audits: Kraken conducts regular security audits to make sure the platform remains secure and up-to-date with the latest practices.

These features make Kraken one of the most secure platforms in the crypto market.

What Makes Kraken Stand Out

Kraken offers a variety of features that make it a popular choice among both new and experienced traders:

- Low Fees: Kraken has competitive trading fees, with a maker/taker fee structure starting at 0.16% for makers and 0.26% for takers. Fees are lower for high-volume traders, and the platform also offers discounts for Kraken Pro users.

- Range of Cryptocurrencies: Kraken supports over 70 cryptocurrencies, including major coins like Bitcoin, Ethereum, and Litecoin, as well as a variety of altcoins. This gives users plenty of options for trading and investing.

- Futures and Margin Trading: Kraken offers futures trading with leverage, allowing traders to speculate on price movements. Margin trading is also available for more experienced users who want to borrow funds to increase their trading potential.

- Staking: Kraken provides staking services for several cryptocurrencies, allowing users to earn rewards by locking up their digital assets in staking pools.

- User-Friendly Interface: Kraken’s platform is known for being easy to navigate, making it a great option for beginners. It also offers advanced trading tools for more experienced users.

Fees

- Trading Fees: Kraken’s fees are competitive and depend on the trading volume. The basic fee structure starts at 0.16% for makers and 0.26% for takers. High-volume traders can pay as little as 0.00% for makers and 0.10% for takers.

- Withdrawal Fees: Withdrawal fees depend on the cryptocurrency. For example, Bitcoin withdrawals cost around 0.0005 BTC, and Ethereum withdrawals cost about 0.01 ETH. These fees are subject to change depending on network conditions.

What’s Next for Kraken in 2025

Kraken is focused on growing its user base and expanding its services in 2025:

- Global Expansion: Kraken plans to continue expanding its reach, particularly in emerging markets like Africa, Southeast Asia, and South America, where cryptocurrency adoption is growing rapidly.

- More Advanced Features: Kraken will likely add more advanced features for professional traders, such as additional trading tools, new margin options, and expanded futures contracts.

- Institutional Clients: Kraken is expected to attract more institutional clients by offering enhanced services like over-the-counter (OTC) trading, custodial solutions, and more robust analytics.

- Regulatory Focus: Kraken will continue to prioritize regulatory compliance as the cryptocurrency industry evolves. This will help them maintain their reputation as a trusted platform in key markets around the world.

References:

- coinbase.com – Coinbase Institutional: Leading the Way in 2025

- youtube.com – Top 5 BEST Crypto Exchanges in 2025: Safe?!

- chaincatcher.com – OKX Star: Focusing on Products in 2025

- altcoinbuzz.io – Kraken’s Big Plan: A New Blockchain Coming in 2025

- blockhead.co – OKX Secures MiCA Pre-Authorization, Paving Way for European Expansion

- crypto.com – Crypto.com’s Vision for 2025: Expansion and Innovation at the Forefront

- bitfinex.com – Bitfinex’s Strategic Partnerships in 2025 to Enhance Trading Infrastructure

- binance.com – Binance’s Global Expansion and Focus on Regulation in 2025

- blockchain.com – Blockchain.com’s Next Steps: More Wallet Features and DeFi Integration in 2025